COVID-19: What You Need To Know

Retail

In these unprecedented times, retailers are responding to the unknown as they see fit. Protecting employee and public health is the top priority as retailers around the world close their brick-and-mortar stores until further notice. Patagonia and TJ Maxx have temporarily shut down all operations, including orders on their websites. Others have opted to keep their online stores open in hopes of making up for even a fraction of the sales they will be losing throughout this pandemic.

In the months ahead, we expect to see more regional and localized supply chains, as well as micro-fulfillment and distribution center pop-ups. A significant increase in online purchases and the desire for delivery will have lasting effects that ripple throughout the retail industry. As the industry shifts to online-only, concerns surrounding packaging and shipment safety are bound to arise. The CDC has yet to release any notes on shipment-specific guidelines, but many are using their guidelines for food as a template. For retailers shipping during these times, contactless deliveries (eSignature), as well as touch-free and cashless transactions, are recommended.

“A significant increase in online purchases and the desire for delivery will have lasting effects that ripple throughout the retail industry.”

Retailers are responding in a variety of ways: shutting down, providing online discounts, pivoting production resources, and donating to charities. In many states, non-essential businesses have been asked to shut down their stores in an effort to avoid sickening employees and customers. To lessen the blow of stores being shut down, several retailers are offering online discounts. Nike and Nordstrom offered 25% sitewide (with exclusions) and waived shipping fees for all orders to boost sales. Corporations like LVMH are repurposing their resources by pivoting production lines to create in-demand supplies, including sanitizing gel and medical face masks. At the same time, several retailers are donating portions of their profit to those in need. FIGS, Clove, and Allbirds are donating products to healthcare workers, while Studs and Everlane are donating partial proceeds to food banks.

Wellness

Public health and safety is the primary concern as COVID-19 continues to spread around the world. To prevent further spread, people are finding ways to stay healthy and happy, while practicing social distancing. They are brushing up on the basics and educating themselves on how to properly wash their hands, as well as taking advantage of all the health resources the internet has to offer.

Interest in the term how to wash your hands has grown over +54% to LY. This spike in washing and sanitizing has led to increased interest in moisturizing solutions. On average, there are 5,500 searches for hand mask, and interest has grown at a rate of +105% since last year. Other hand healing treatments include hand balm (+11% to LY) and cuticle oil (+24% to LY). When it comes to hand balm, Aesop, Rituals, and Lano are the top associated brands.

As more people are stuck at home, we are seeing a dramatic uptick in virtual therapy and virtual workouts. Historically speaking, interest in both has hit peak popularity.

Searches for virtual workout and virtual therapy between March 24, 2019 and March 8, 2020.

Many workout studios have moved their classes to Instagram Live. Several publications, including Vogue and Elle, have released guides on how to cope with anxiety and isolation. On a larger scale, Philadelphia area mental health professionals are offering free therapy for healthcare workers.

While people take advantage of online resources to cope with virus anxiety, many are turning to immune-boosting foods and supplements to prevent the virus altogether. Online searches for immunity-boosters, like vitamin C (+24% to LY), echinacea (+9% to LY), and elderberries (+45% to LY) are soaring. Despite the rising interest, it’s important to note that these ingredients do not prevent or treat COVID-19. Clearly and effectively communicating this to consumers is of the utmost importance.

Category Shifts

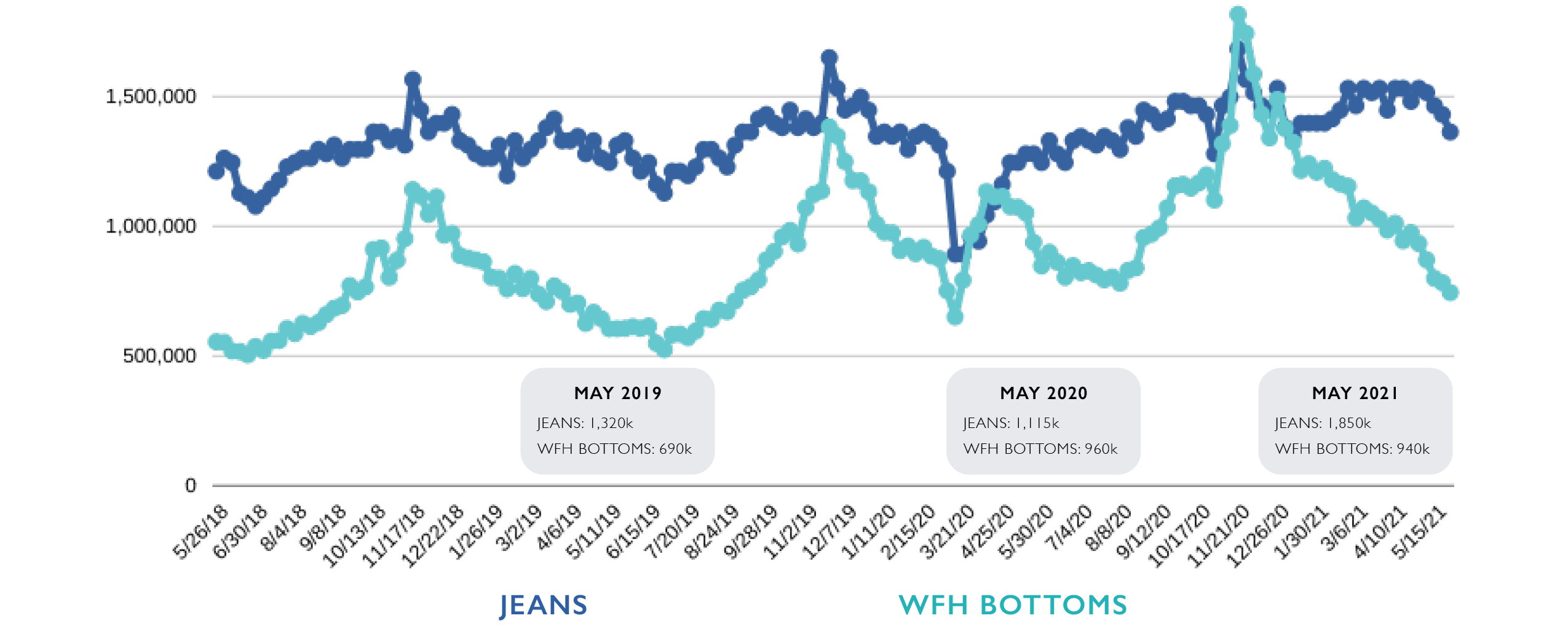

According to Statista, the global loungewear market is expected to reach $37.7B by 2021. Consumers are seeking out comfortable fashion as unemployment and WFH rates rise. On average, there are 184K searches for loungewear in the US this month and interest has grown at a rate of +39% since last year (+27% since the first week of January). This is an extreme volume trend with a low discount level. Calvin Klein, Micha Lounge, Esprit, and Missguided are the top associated brands.

Google searches for DIY hand sanitizer have grown +600% to LY, while DIY beauty is -23% to LY and DIY skincare is +4% to LY. Consumers are seeking out DIY alternatives to Purell, which is being sold on Craigslist for 10x its normal price. Stemming from the scarcity: DIY hand sanitizer with hydrogen peroxide is +90% to LY and DIY hand sanitizer with aloe vera is +60% to LY. Brands like Blueland, Loli Beauty, and Luxe Botanics have stepped up, sharing DIY hand sanitizer recipes on Instagram.

To learn more about how COVID-19 is impacting consumer behavior, please contact hello@trendalytics.co